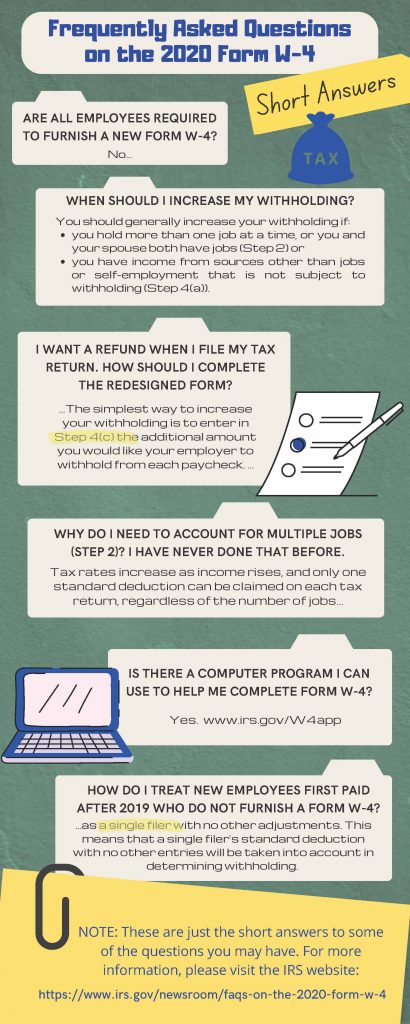

Come tax time, the W-4 is an important form that allows your employer to withhold the correct federal income tax from your pay. Without adequately completing this form, in some instances, you may end up owing the Government money come tax time. In 2020, the old faithful form got a redesign that reduced the form’s complexity and increased the withholding system’s transparency and accuracy. While it uses the same underlying information as the old design, it replaces complicated worksheets with more straightforward questions that make accurate withholding easier for employees. However, with new forms, there always come questions. Here are the short answers to some of the most common questions regarding the new 2020 Form W-4: