Every February, the United States honors the contributions and sacrifices of African Americans who helped shape the nation. In our diverse, multicultural community here at Henrico, seeking to understand and support our peers goes a long way to promoting positive relationships and elevating respect for the experiences and insights of all cultures.

This month, we encourage you to participate in celebrating the black community’s rich cultural heritage, triumphs, and adversities. In Henrico County, there are many opportunities to immerse yourself in Black History Month and engage our community through events and connections.

Building positive relationships with others has benefits beyond forging connections and deeper understanding. Studies show that having positive, close relationships with others can improve your ability to recover from stress, anxiety, and depression and can benefit your heart health. Each February, the National Heart, Lung, and Blood Institute (NHLBI) and The Heart Truth celebrate American Heart Month by motivating Americans to adopt healthy lifestyles to prevent heart disease.

To understand more about heart health, a Diversity, Equity, and Inclusion (DEI) Division team member interviewed Sydnei Douglas, a trainer and health enthusiast in the Department of Human Resources’ Fitness and Wellness Division, to ask her thoughts about the importance of heart health. These are some of the highlights of the conversation:

To understand more about heart health, a Diversity, Equity, and Inclusion (DEI) Division team member interviewed Sydnei Douglas, a trainer and health enthusiast in the Department of Human Resources’ Fitness and Wellness Division, to ask her thoughts about the importance of heart health. These are some of the highlights of the conversation:

Why is heart health so important?

Sadly, cardiovascular disease is a public health crisis as it is the leading cause of death in the United States. About one person dies every 33 seconds in the U.S. from cardiovascular disease or related conditions. A big reason for this could most likely be hypertension—high blood pressure—which is the number one cause of cardiovascular disease. About 40-45% of the U.S. Adult population has hypertension. That’s almost half of our adult population!

I think it’s important for our employees to be aware of this and to take steps towards prevention. It’s never too late for a change. Start with the small steps.

What do you think people should know about heart health or heart disease?

When you think about our workplace setting, a good portion of our employees experience a high volume of sedentary activity because of sitting at our desks. Sedentary behavior and lack of physical activity can also play a huge role in cardiovascular disease. For employees, it’s important to note that we do sit down a lot of the time throughout the day, so one of the things we can do is be more intentional about moving more and getting more physical activity in our daily lives.

What are three things one can do to be more intentional about heart health? What advice would you give?

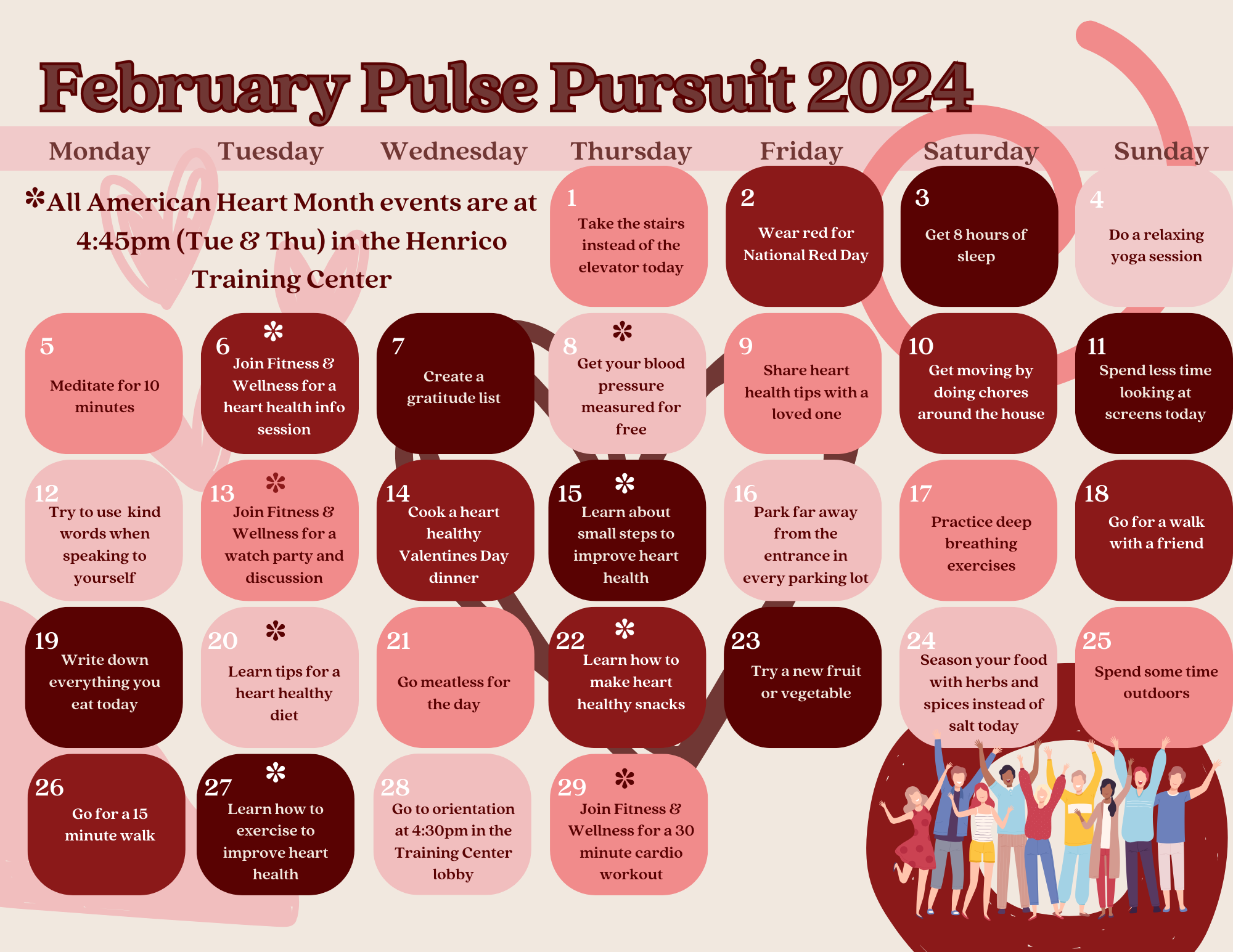

The first thing would be to move more. The steps you take towards prevention don’t have to be super intense. Everybody is on a different journey and physical level, so start with what is capable for you. Perhaps start with taking the stairs or getting up to walk around at certain times during the day. Being more physically active in small increments over time is a great way to start being more intentional with your heart and overall health.

We offer many classes throughout the day at the Training Center for employees to be active. It is also a great way to make connections with other employees! Exercising in groups brings about a sense of community, holds you accountable, and empowers you to overcome challenges.

Changing your diet is a big one. A small step I recommend is cutting down on fried foods. Fried foods are filled with fat, which can cause plaque buildup in your arteries and blood vessels. We offer many classes and workshops—for both physical activity and nutritional knowledge—throughout the year that our employees participate in.

Get involved with the programs we have available. You can find this information on the Fitness and Wellness SharePoint site.

If you are a smoker, choose a quit date. There are good resources out there that provide knowledge and support throughout your journey, including Employee Health Services and our Anthem Employee Assistance Program (EAP). And if you aren’t a smoker, vow never to start!

Even if you have high blood pressure, which is a huge risk for cardiovascular disease, it can be reversed. Making healthier choices now can improve your heart health over time.

How can employees celebrate American Heart Month and Black History Month in February?

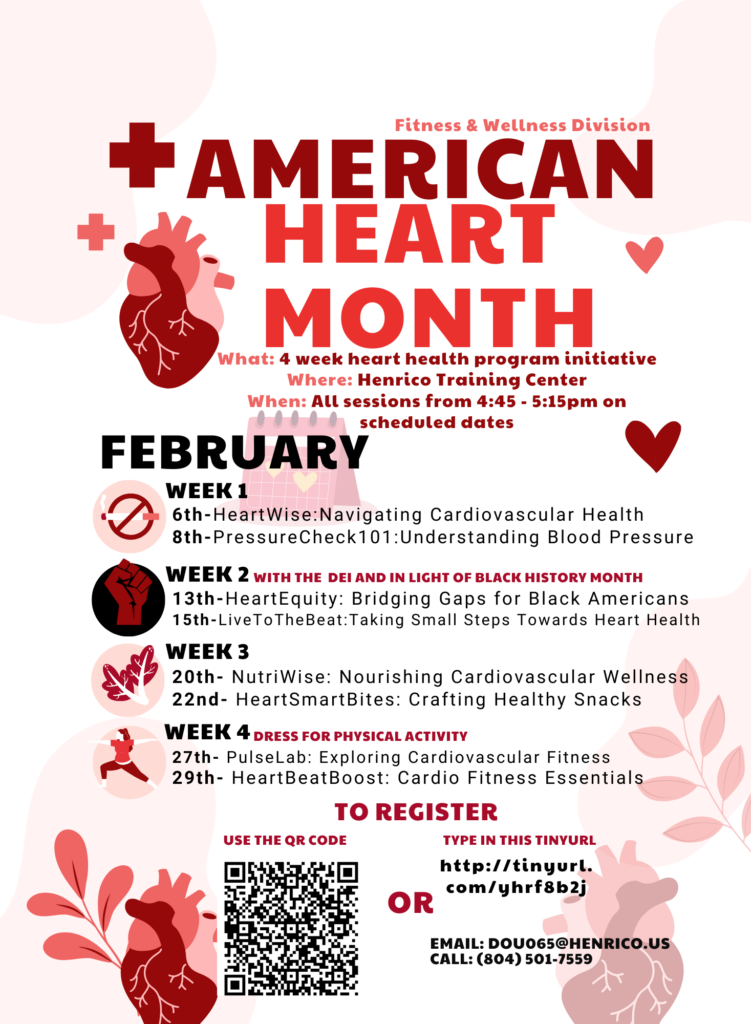

A good way would be to attend our Heart Health Initiative program in February! I will be doing a bunch of different workshops and educational initiatives to help our employees understand how to improve our heart health. You can register online or email me at [email protected].

Week two of this initiative will be dedicated to health equity, where we will be talking about health disparities regarding cardiovascular health in the black community. This is a great opportunity to educate yourself about the history behind these disparities and the social determinants and recognize black healthcare professionals and clinicians who have impacted cardiovascular health.