A very important part of making your tax filing easier is to make sure you withheld enough tax. If you owed taxes or received a large refund last year, consider adjusting your withholding. Changing your withholding can help you avoid a tax bill or let you keep more money each payday. In addition, life changes – getting married or divorced, welcoming a child, or taking on a second job – may also mean changing withholding. To do this, you will need to submit an updated Form W-4. This may seem overwhelming or confusing, but it doesn’t need to be. Here are some frequently asked questions on the new Form W-4 their answers:

Where can I download or update Form W-4?

The form can be downloaded from the IRS website, or you can update your withholding certificate in Oracle; see the below steps:

- Employee Direct Access

- Salary Related

- Federal & State Tax Forms

You must click the update tab on the bottom right of the page to make changes. Once you’ve completed the necessary steps, submit the form to update the system.

Why was Form W-4 redesigned?

The new design reduces the form’s complexity and increases the transparency and accuracy of the withholding system. While it uses the same underlying information as the old design, it replaces complicated worksheets with more straightforward questions that make accurate withholding easier for employees.

What happened to the withholding allowances?

Allowances are no longer used for the redesigned Form W-4. This change is meant to increase the form’s transparency, simplicity, and accuracy. In the past, the value of a withholding allowance was tied to the personal exemption amount. Due to changes in law, you currently cannot claim personal exemptions or dependency exemptions.

My tax situation is simple. Should I still complete every step?

No. The form is divided into five steps. The only two steps required for all employees are Step 1, where you enter personal information like your name and filing status, and Step 5, where you sign the form. Complete Steps 2 – 4 only if they apply to you. Doing so will make your withholding more accurately match your liability.

What happens if I only fill out Step 1 and then sign the form?

The system will compute your withholding based on your filing status’s standard deduction and tax rates, with no other adjustments.

I want a refund when I file my tax return. How should I complete the redesigned Form W-4?

The redesigned Form W-4 makes it easier for you to have your withholding match your tax liability. But if you prefer to have more tax than necessary withheld from each paycheck, you will get that money back as a refund when you file your tax return (keep in mind though you do not earn interest on the amount you overpay). The simplest way to increase your withholding is to enter in Step 4(c) the additional amount you would like your employer to withhold from each paycheck.

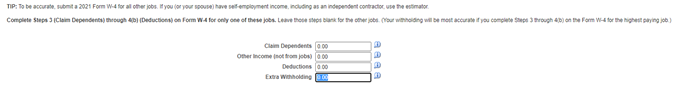

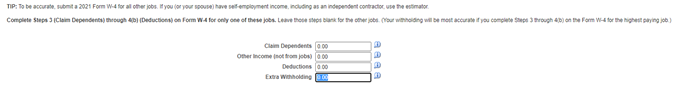

In Oracle:

**Note, even if you don’t have any income tax withheld from your wages, you may get a refund if you are eligible for tax credits such as the Earned Income Credit, the Additional Child Tax Credit, or American Opportunity Credit. **

Why do I need to account for multiple jobs (Step 2)? I have never done this before.

Tax rates increase as income rises, and only one standard deduction can be claimed on each tax return, regardless of the number of jobs. Therefore, if you have more than one job at a time or are married filing jointly and both you and your spouse work, more money should usually be withheld from the combined pay for all the jobs than would be withheld if each job was considered by itself. As a result, you must adjust your withholding to avoid owing additional tax and potential penalties when you file your tax return. This has been true for many years; it did not change with the recent tax law changes. The old Form W-4 accounted for multiple jobs using detailed instructions and worksheets that many employees may have overlooked. Step 2 of the redesigned Form W-4 lists three different options to choose from to make the necessary withholding adjustments. Note that, to be accurate, you should furnish a new Form W-4 for all these jobs.

If you are still unsure of the proper amount for your withholding, use the Tax Withholding Estimator to help you determine the right amount of tax to have withheld from your paycheck. This tool on IRS.gov will help determine if you need to adjust your withholding and submit a new Form W-4.

https://www.irs.gov/individuals/tax-withholding-estimator

For questions or additional information, please visit the IRS website.

https://www.irs.gov/newsroom/faqs-on-the-2020-form-w-4

Read More

April is National Child Abuse Prevention Month. Please consider sharing your time with Henrico CASA to help improve the well-being of local children who have experienced abuse and neglect. Last year, Henrico CASA (Court Appointed Special Advocates, Inc.) served 385 children and teens whose families were in crisis. Judges in Juvenile and Domestic Relations Court-appointed volunteer CASAs for each of these children. CASAs spoke up for these children, working with County employees in court and the community, promoting the children’s well-being, and establishing a network of supportive connections.

April is National Child Abuse Prevention Month. Please consider sharing your time with Henrico CASA to help improve the well-being of local children who have experienced abuse and neglect. Last year, Henrico CASA (Court Appointed Special Advocates, Inc.) served 385 children and teens whose families were in crisis. Judges in Juvenile and Domestic Relations Court-appointed volunteer CASAs for each of these children. CASAs spoke up for these children, working with County employees in court and the community, promoting the children’s well-being, and establishing a network of supportive connections.

The new Advocate for the Aging, Emily Atkinson, MPH, CHES, was hired that same month and quickly got to work serving the residents of Henrico County. In this position, Emily has helped over 300 residents through information and referral services and aided over 600 residents through programming and community events. When residents call Emily, she quickly gets to work deciphering which resource or services would be the best fit for their particular situation. She knows that not all cases are identical, and each individual who calls receives unique and tailored advice.

The new Advocate for the Aging, Emily Atkinson, MPH, CHES, was hired that same month and quickly got to work serving the residents of Henrico County. In this position, Emily has helped over 300 residents through information and referral services and aided over 600 residents through programming and community events. When residents call Emily, she quickly gets to work deciphering which resource or services would be the best fit for their particular situation. She knows that not all cases are identical, and each individual who calls receives unique and tailored advice. (HAPS) by transitioning the program from an annual event into a club for seniors that meets monthly. The new HAPS program serves as an opportunity for older Henrico residents to become ambassadors for their communities. These ambassadors attend monthly meetings, learn about available resources in the Henrico community, distribute information on resources and services to other community members, and give feedback on aging services in Henrico County. HAPS meetings occur the third Wednesday of each month from 10 am – 11 am and rotate between each area library every month to make attendance accessible across the county.

(HAPS) by transitioning the program from an annual event into a club for seniors that meets monthly. The new HAPS program serves as an opportunity for older Henrico residents to become ambassadors for their communities. These ambassadors attend monthly meetings, learn about available resources in the Henrico community, distribute information on resources and services to other community members, and give feedback on aging services in Henrico County. HAPS meetings occur the third Wednesday of each month from 10 am – 11 am and rotate between each area library every month to make attendance accessible across the county.

2022 is the 6th Anniversary of the Public Safety Games and this year’s Battle for the Throne of “Fittest Public Safety Division” will be the most thrilling of all. New this year, the Public Safety Division with the most accumulated points throughout all events will be declared the winner. Therefore, participation is more crucial than ever before. This year’s competitions will kick off on Friday, May 6, as an all-employee “civilian day” with fun and social challenges. Employees who choose to participate can gain one point toward the division they of their choice. The main competitions will ensue in the weeks following: The Endurance Event, The Work Capacity Event, The Relative Strength Event, and then the Final Team Obstacle Course held on Friday, June 3. Individual competitors can participate in one or more of their chosen events, and each event will recognize its winner. Team competitors will partake as a pair in all events, with only the top teams from each division invited to the Final Obstacle Course. The accumulated total points from each competition (all individual, team, and mini) will determine who is the Fittest Public Safety Division of the year. Anyone of any age and fitness level has an opportunity to contribute to their division’s point totals!

2022 is the 6th Anniversary of the Public Safety Games and this year’s Battle for the Throne of “Fittest Public Safety Division” will be the most thrilling of all. New this year, the Public Safety Division with the most accumulated points throughout all events will be declared the winner. Therefore, participation is more crucial than ever before. This year’s competitions will kick off on Friday, May 6, as an all-employee “civilian day” with fun and social challenges. Employees who choose to participate can gain one point toward the division they of their choice. The main competitions will ensue in the weeks following: The Endurance Event, The Work Capacity Event, The Relative Strength Event, and then the Final Team Obstacle Course held on Friday, June 3. Individual competitors can participate in one or more of their chosen events, and each event will recognize its winner. Team competitors will partake as a pair in all events, with only the top teams from each division invited to the Final Obstacle Course. The accumulated total points from each competition (all individual, team, and mini) will determine who is the Fittest Public Safety Division of the year. Anyone of any age and fitness level has an opportunity to contribute to their division’s point totals!